The GENIUS Act, which established the first federal framework for stablecoins, has become a flashpoint in the escalating tension between the cryptocurrency industry and traditional banking. While the law prohibits stablecoin issuers from paying interest directly to holders, platforms like Coinbase and Circle have introduced “rewards” programs that functionally mimic interest-bearing accounts. Banks argue that this undermines their core business model and exposes consumers to risk, since stablecoins lack FDIC insurance and could siphon trillions in deposits away from the traditional banking system. The Treasury Department has echoed these concerns, warning of potential economic disruption if stablecoins continue to offer competitive yields.

The limitations of the GENIUS Act have sparked debate over how best to regulate the fast-evolving crypto sector. Traditional banks and their lobbyists favor targeted amendments that would close specific loopholes, such as banning “rewards” programs that mimic interest payments. Bank lobbyists are pushing for this kind of surgical intervention, arguing that it would prevent stablecoin issuers from undermining deposit-based lending without overhauling the entire regulatory landscape.

In contrast, the proposed Digital Asset Market Clarity Act is a broader framework that aims to create a comprehensive set of rules governing the entire digital asset ecosystem. This would include not only stablecoins, but also crypto exchanges, custody services, and decentralized finance platforms. Supporters of this approach argue that piecemeal fixes risk stifling innovation and creating regulatory uncertainty. They believe a holistic framework is necessary to define the roles of agencies like the SEC, CFTC, and Treasury, while also protecting consumers and ensuring market integrity.

This tension between narrow fixes and comprehensive reform reflects deeper philosophical divides: banks seek to preserve stability and control, while crypto advocates push for flexibility and innovation. The outcome of this debate will shape how digital assets are integrated into — or kept separate from — the traditional financial system.

USDC Market Cap and Banking Metrics

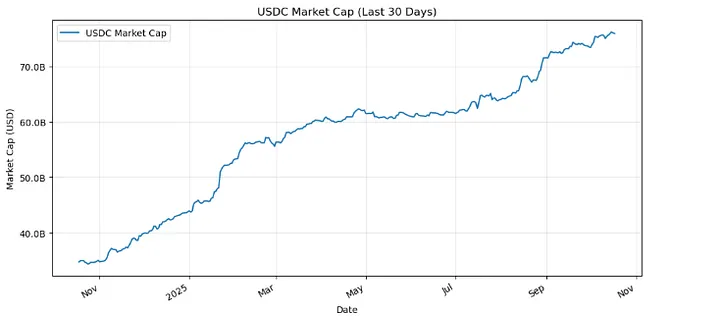

Over the past year, USDC’s market capitalization has shown a steady upward trend, rising from around $40 billion to nearly $70 billion, with notable growth spurts in January and July. This trajectory unfolds within a macroeconomic backdrop shaped by elevated short-term interest rates, money market fund (MMF) expansion, and a post-2023 banking system recalibration.

When risk-free yields such as those from SOFR and 3-month Treasury bills are high, the opportunity cost of holding a non-yielding stablecoin like USDC increases. This dynamic often redirects cash toward MMFs, which invest at those rates and may even channel funds into the Federal Reserve’s Overnight Reverse Repo (ON RRP) facility. Meanwhile, H.8 bank deposit data reflects shifts in traditional bank funding as consumers and institutions reallocate capital.

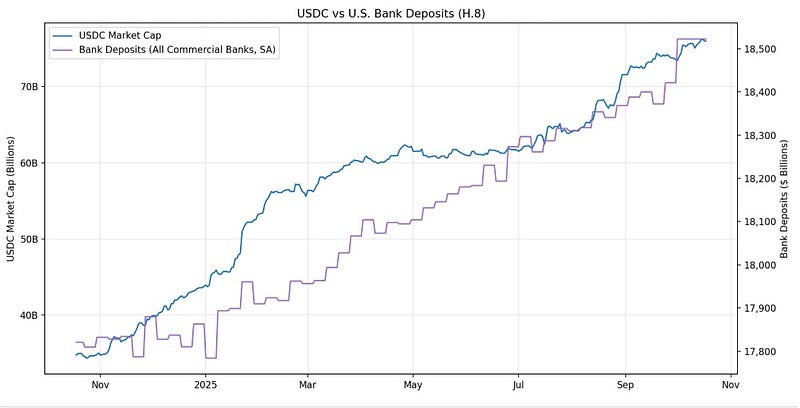

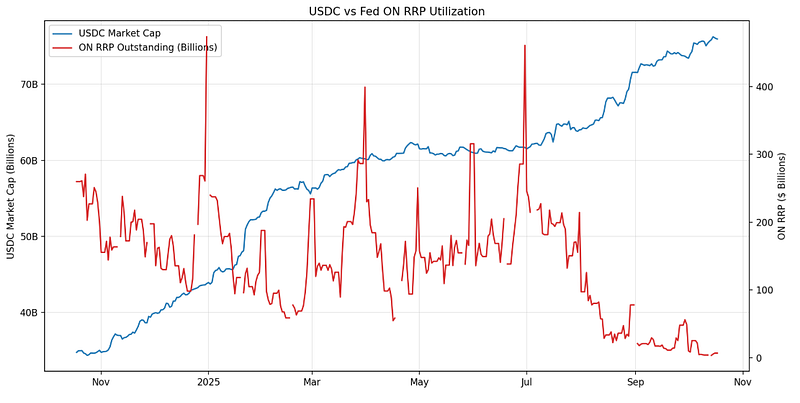

As of October 17, 2025, USDC’s market cap stood at approximately $75.93 billion, while U.S. commercial bank deposits totaled around $18.52T — highlighting the scale of traditional finance versus tokenized dollars. With short-term rates elevated (SOFR at 4.29%, 3-month Treasury yield at 4.03%), the opportunity cost of holding non-yielding stablecoins rises. ON RRP balances at $6.96B reflect institutional liquidity preferences, reinforcing the competitive tension between stablecoins and traditional banking products.

If you are interested in learning how to do this analysis, follow along with my code on GitHub.

USDC’s market capitalization rose steadily over the past year, with notable surges around January and July. This upward trend reflects growing adoption of stablecoins as a viable alternative to traditional banking products. As users seek faster, lower-cost, and more accessible financial tools, USDC’s expansion signals a shift in consumer trust, from centralized banks to decentralized digital assets. The upward trend in the USDC market cap shown in the chart aligns with several macroeconomic and regulatory developments during the same period. Mid-2025 saw the passage of the GENIUS Act, which created the regulatory clarity that likely encouraged broader adoption of USDC. Later in the year, the Federal Reserve cut interest rates twice, in September and October, shifting monetary policy toward easing, which tends to increase risk appetite and liquidity, supporting stablecoin usage. At the same time, crypto market dynamics, including Bitcoin price rallies and ETF inflows, drove demand for stablecoins as traders positioned capital. Additionally, USDC-specific factors such as Circle’s growing integrations and exchange “rewards” programs that mimic interest-bearing accounts attracted more balances, despite regulatory scrutiny.

A comparison between USDC’s market capitalization and U.S. commercial bank deposits reveals a growing competitive tension in the financial system. While USDC has steadily climbed to nearly $76 billion, traditional bank deposits hover around $18.52 trillion, showing slower and more volatile growth. This divergence suggests a shift in consumer and institutional preferences, with tokenized dollars gaining traction as an alternative to conventional banking products.

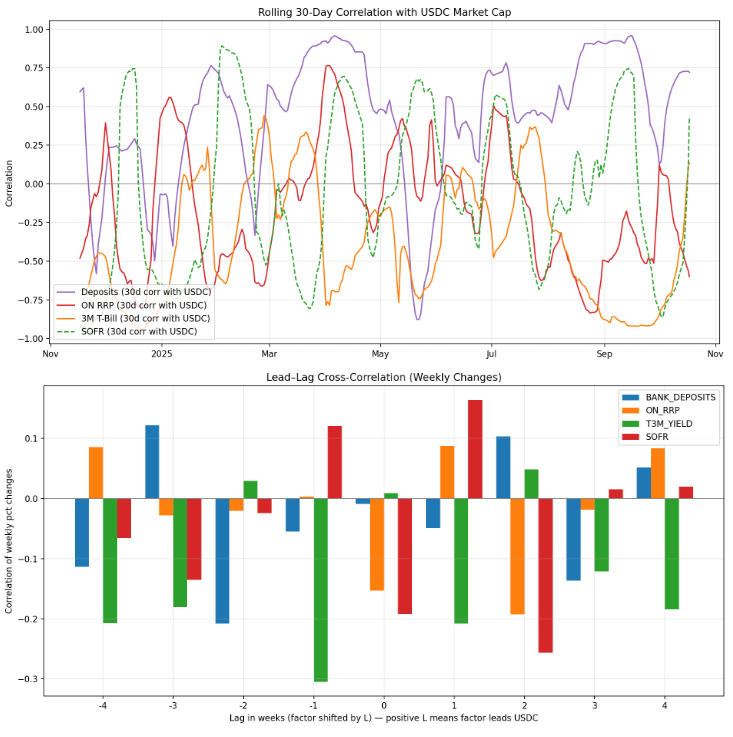

The lead-lag cross-correlation chart reveals that ON RRP (overnight reverse repo) and SOFR (secured overnight financing rate) exhibit modest leading behavior at short horizons, particularly at +1 week, implying liquidity tightening or funding cost changes often precede shifts in stablecoin supply.

Conversely, bank deposits show a slight lagging tendency, with negative correlations at -1 and -2 weeks, suggesting that deposit outflows may follow USDC expansion rather than drive it. Interestingly, the 3M Treasury yield sends mixed signals: a weak positive correlation when leading by 1–2 weeks but a stronger negative correlation when lagging, highlighting its dual role as both a liquidity proxy and a risk sentiment indicator.

USDC supply dynamics respond more acutely to shifts in short-term funding conditions than to movements in traditional banking deposits. This behavior underscores the stablecoin’s heightened sensitivity to liquidity signals and monetary policy transmission mechanisms, particularly those reflected in repo operations and SOFR rates.

When rates like SOFR and Treasury yields rise, the correlation with USDC tends to weaken or turn negative, suggesting that higher yields may divert capital away from non-yielding stablecoins. Additionally, lead-lag patterns indicate that changes in traditional financial metrics often precede movements in USDC, implying that stablecoin adoption may be reactive to broader economic trends rather than driving them. This supports the view that tokenized dollars are increasingly integrated into the macro-financial landscape, responding to shifts in yield, liquidity, and trust.

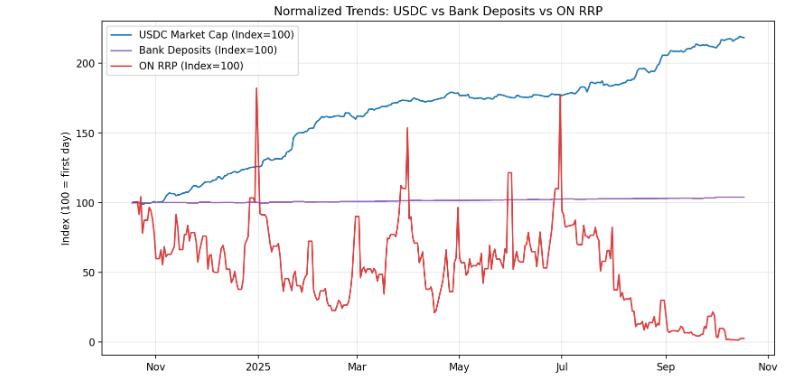

USDC shows a consistent upward trajectory, more than doubling from its baseline, signaling sustained growth in stablecoin adoption. In contrast, bank deposits remain virtually flat, indicating minimal movement in traditional banking liquidity relative to the rapid expansion of USDC.

The Overnight Reverse Repurchase Agreement (ON RRP), however, exhibits pronounced volatility, with sharp spikes and deep troughs, reflecting episodic liquidity absorption by the Federal Reserve.

ON RRP are short-term transactions where the Federal Reserve borrows cash from financial institutions overnight by selling them securities and agreeing to repurchase them the next day. This temporarily removes excess money from the economic system and helps the Fed control short-term interest rates. High ON RRP usage usually means there’s a lot of extra liquidity in the market, and institutions prefer to park funds safely with the Fed rather than lend elsewhere.

These fluctuations in ON RRP highlight its role as a short-term liquidity buffer. At the same time, the steady rise in USDC underscores a structural shift toward digital dollar instruments that operate independently of traditional deposit flows. The stark divergence between these series suggests that stablecoin growth is decoupled from conventional banking reserves and more influenced by broader liquidity conditions and monetary policy interventions.

Comparing the USDC market cap with the ON RRP utilization reveals a striking divergence in institutional liquidity behavior. While USDC’s market cap steadily increased throughout the year, ON RRP balances fluctuated and ultimately declined. This suggests that institutions may be reallocating capital away from the Federal Reserve’s overnight facility and toward tokenized assets. The downward trend in ON RRP utilization, especially during periods of USDC growth, reinforces the idea that stablecoins are becoming a more attractive liquidity option, challenging the role of traditional tools in short-term cash management.

The Trillion-Dollar Realignment

The rise of tokenized dollars like USDC is a structural challenge to the foundations of traditional banking. As the GENIUS Act and its surrounding controversy reveal, stablecoins are forcing regulators, banks, and policymakers to confront uncomfortable questions about competition, consumer protection, and the future of financial infrastructure. The banking industry’s alarm over “rewards” programs is about defending a business model built on insured deposits and interest-bearing accounts that is now facing pressure from decentralized platforms offering speed, transparency, and yield.

There is no doubt about it, stablecoins are gaining ground. USDC’s market cap has surged while bank deposits have stagnated, and ON RRP balances have declined. Correlation and lead-lag analysis show that stablecoin adoption is increasingly responsive to macroeconomic conditions, particularly interest rates and institutional liquidity flows. Normalized trend comparisons reveal that USDC is outpacing legacy financial instruments in relative growth, and the divergence between USDC and ON RRP utilization suggests a reallocation of institutional capital toward digital assets.

Stablecoins offer programmable liquidity, global reach, and real-time settlement, features that legacy systems struggle to match. Yet they also raise questions about systemic risk, regulatory oversight, and consumer safeguards. The GENIUS Act may be the first attempt to draw boundaries, but the fight over how to regulate, integrate, or resist tokenized finance is far from over.

Behind the scenes, the bank lobby is a powerful force shaping this debate, pushing for narrow fixes that protect deposit-based lending and preserve its dominance in the financial system. But trust is a central issue on both sides: as public confidence in institutions and government continues to erode, people are increasingly turning to decentralized alternatives. This shift threatens the stability of traditional finance, which relies on trust in regulated systems, insured deposits, and centralized oversight.